Direct Lending Solutions

Fix and Flip

Short-Term Financing for your fix and flip projects

- High Leverage, 6, 12 and 18 Month Terms

- 100% of Rehab Budget, Up to 92.5% Loan to Cost

- Easy Qualification Process

- Direct Lender

- Simplified Draws

- Close in 5 Days

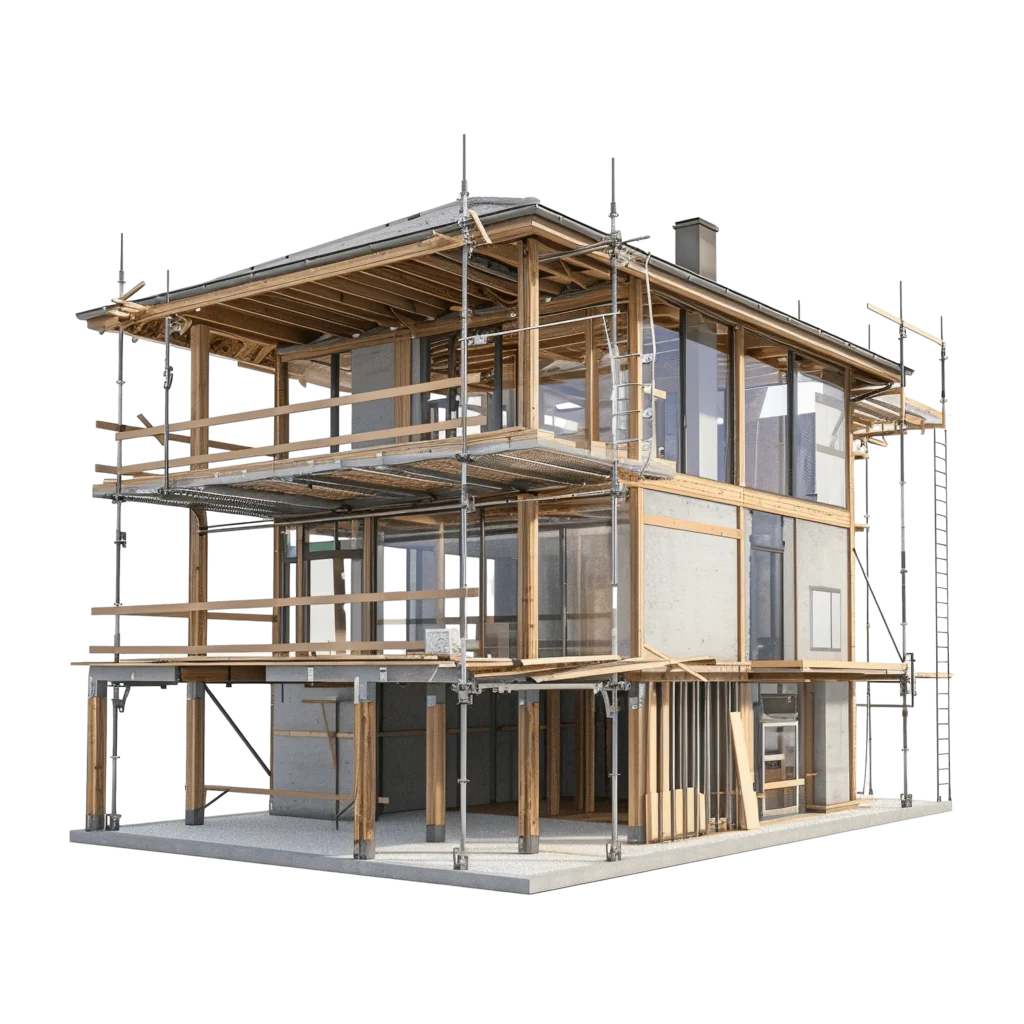

Ground Up Construction

Construction Loans for seasoned home builders who want to scale their business

- High Leverage

- Up to 90% LTC and 75% LTARV

- Large Developments up to $15 million

- Competitive Rates/Fees

Rental Loans (DSCR)

- Rates starting at 5.99%

- Up to 80% LTV

- Purchase, Rate & Term or Cash Out

- 30 Year Fixed Rates

Bridge Loans

Flexible, long-term financing options for rental portfolios.

- Quick Closing, in as Little as 5 Days

- Rate/Term or Cash Out

- Hybrid Appraisal Only

- Minimal Documentation

Frequently Asked Questions

What types of properties do you fund?

We fund a wide range of real estate investment properties, including fix-and-flips, ground-up construction, and rental properties.

How long does the approval process take?

Our streamlined process allows for approvals within 24 hours, ensuring you get funding quickly.

What are your interest rates?

Interest rates vary depending on the loan type, borrower qualifications, and market conditions. Fix-and-flip loans start as low as 11%, while rental loans begin at 7%.

Do you require a credit check?

Yes, we evaluate creditworthiness as part of our underwriting process, but our focus is on the investment potential of the property.

Are your loans available to first-time investors?

Absolutely! We work with investors of all experience levels and can tailor solutions to fit your needs.

What is the loan-to-value (LTV) ratio for your loans?

LTV varies by loan product. For example, rental loans offer up to 80% LTV, while fix-and-flip loans can provide up to 92.5% LTC and 100% of the rehab budget.

Are your loans limited to specific locations?

Our loan products are available in multiple states. Contact us to confirm availability in your area.

What documentation do I need to apply?

Typical documents include LLC docs, budget, and bank statements. Specific requirements depend on the loan type.

Ready to Fund Your ext Investment?

Take the next step in achieving your real estate goals. Whether you’re ready to apply or have questions, we’re here to help you move forward with confidence.

-

Call:

214-385-4374